Understanding Market Structure: The Key to Unlocking Forex Success

The Forex market is a complex and dynamic environment, with prices constantly fluctuating in response to global events and economic indicators. To navigate this landscape, traders need to understand the underlying market structure and how to identify key levels of support and resistance.

Market structure refers to the organization of price movements, including trends, ranges, and reversals. By recognizing these patterns, traders can anticipate potential price movements and make informed decisions.

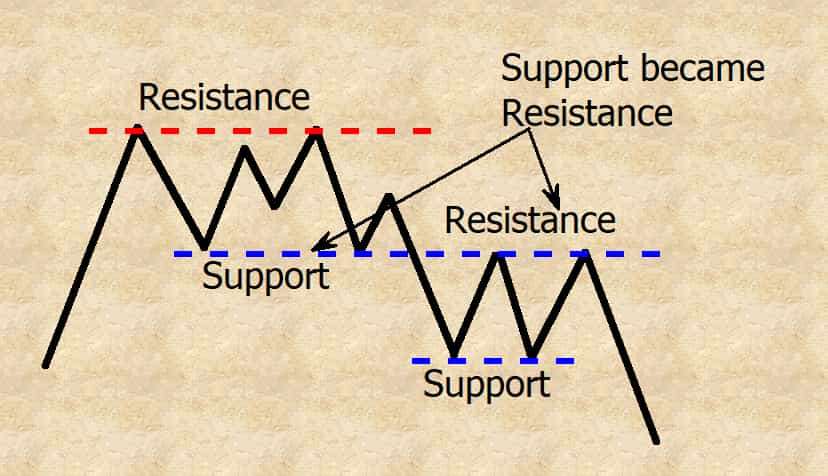

Support and resistance levels are critical components of market structure, serving as barriers that prevent prices from moving beyond certain points. Support levels act as a floor, while resistance levels act as a ceiling.

– Support: A level where buying pressure increases, preventing price from falling further

– Resistance: A level where selling pressure increases, preventing price from rising further

By identifying these levels, traders can:

– Determine potential entry and exit points

– Set realistic price targets

– Manage risk and limit losses

Watch the Video below:

@prolificfx_ Introduction to market structure #learnontiktok #money #forextrading #cryptocurrency ♬ Boundless Worship – Josué Novais Piano Worship

In Forex, understanding market structure and support and resistance levels is crucial for success. By recognizing these key elements, traders can develop a more informed and effective trading strategy.”